Operator-Investors: The Future of Venture Capital

There's a new trend in venture capital that has the potential to entirely transform early-stage investing.

Many of the best coaches in history have been players themselves. From the legendary Phil Jackson, who led the Chicago Bulls and LA Lakers to a record-setting eleven NBA championships, to Alex Ferguson who managed Manchester United through 38 trophies, coaches that have been athletes themselves can have a unique ability to outperform.

A similar dynamic has been growing in venture capital and has the potential to entirely transform early-stage investing.

In the first wave of operator-investors, established funds like a16z, Greylock, and Sequoia hired vertical-specific Former Operators who brought successful entrepreneurial track records, relationships in the industry, and experience navigating challenges that founders face.

The second (and more recent) wave was Operator Angels. Angel networks popped up in every sub-category and region, enabling current startup operators (who have accrued enough personal wealth) to help reshape early-stage cap tables by bringing in “smart money.” The rise of AngelList and programs like On Deck’s Angel Fellowship has further enabled current entrepreneurs to play a more active role in the startup ecosystem even while they’re still building themselves.

As more Operator Angels have emerged, founders have started to realize the unique value they can add to a cap table.

“Empathy is going to become a key undertone of investing.

Investors who have run companies and raised capital bring empathy that an investor coming from a consulting background just can’t. Founders are becoming smarter about who they raise capital from.”

— Utsav Somani, Partner at AngelList India, on the DesiVC podcast

The newest wave of this trend is Operator Fund Managers. An increasing number of current operators are now raising venture funds, fueled by a combination of: (a) founder preference for operator-investors to fill out cap tables, (b) easing regulations by the US Government that have made it easier to launch venture capital funds, and (c) the creation of AngelList Rolling Funds that offer substantial benefits to emerging fund managers.

These trends have propelled current operators — founders and early employees of startups, execs at large tech companies, and experts in specific domains — to raise their own funds, leveraging their full-time job and sector knowledge to source, invest in, and support great startups. These new funds have come in a range of forms: Solo Operator Funds (Sahil Lavingia from Gumroad), Multi-Operator Funds (Todd Goldberg from Eventjoy & Rahul Vohra from Superhuman), and Operator & Investor Partnership Funds (Lolita Taub from Catalyte & Jesse Middleton from Flybridge Capital Partners).

This context led our team (Siya & Taylor) to launch Pathway Ventures, an early-stage fund focused on the human side of the future of work. Both of us have built and scaled Edtech and Future of Work startups our entire careers, and between the two of us, have been functional leaders across product, marketing, and BizOps. Alongside building Pathway, Siya leads Startups at MongoDB and Taylor is the Chief Operating Officer of FutureFit AI.

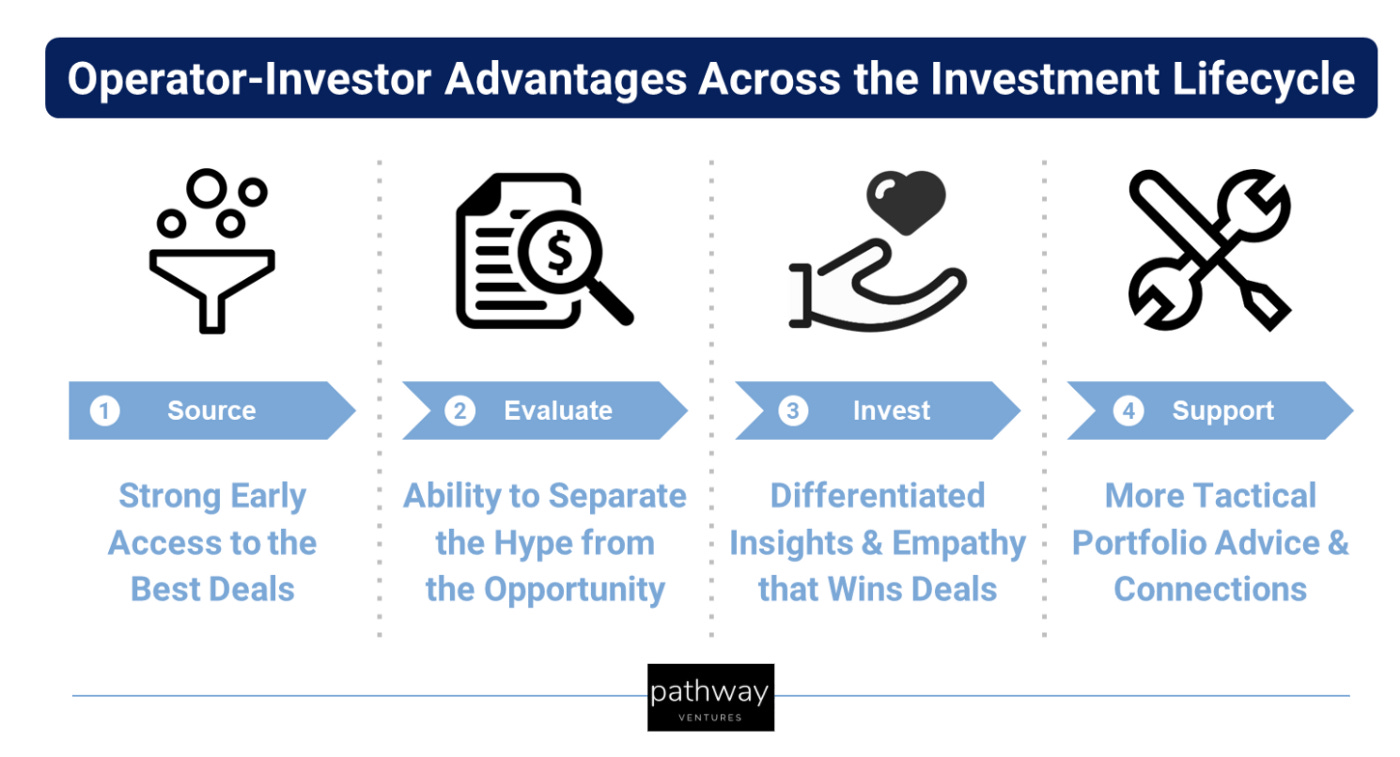

While we both have been Edtech investors before as well, many have asked us what gives Pathway an edge over funds run by full-time investors. From our own experience, as well as from conversations with founders, LP’s, and fellow Operator-Investors, there are four core reasons why we’re bullish that Operator-Investors are the future of early-stage venture capital.

Source: Strong Early Access to the Best Deals

Operators see deals 9+ months before more traditional investors do. When a founder is prototyping ideas, researching market segments, and preparing for launch, they don’t call VCs for advice. They call operators who have had similar experiences.

When Springboard was a 15-people company, Siya reached out to founders & operators at Series A Edtech companies (such as our friends at Freckle) to get advice on fundamental business questions: how to evaluate new markets, find office spaces, and establish internal performance review systems. These operators knew about Springboard before our seed round investors did. Pathrise (now seed-stage) reached out to Springboard to get similar advice when they started out.

Shared experiences from the workplace or a common sector enable far deeper relationships than a traditional VC can form through sourcing at events and having regular check-ins. The emergence of “Mafia” funds has further made it easier for current operators to get a first look at new founders coming out of their tech alumni networks.

An operator’s identity becomes a channel for deal flow. In the future, our hypothesis is that every “plugged in” operator will be investing — dominating pre-seed and seed rounds, whether as an Operator Angel or an Operator Fund Manager.

Evaluate: Ability to Separate the Hype from the Opportunity

Operator-Investors can do much deeper diligence on companies within their sector. Given their work on the ground and their sector-specific network, operator-investors have a stronger sense of reality: emerging trends, what users want, and what types of partnerships/distribution channels work.

Bruno B. Ferrari Faviero, a Product Manager at Palantir & Partner at Graduate Fund, says he met a promising company that was getting shunned by traditional investors because it was trying to sell to airports (“they believed it was a niche market with long sales cycles”). But Bruno was more bullish on their strategy since he was working in the sector, knew the stakeholders, and understood the value of the company’s solution in a relatively underserved market.

Operator-investors having deep subject-matter expertise helps them identify opportunities that traditional VCs may miss and also overlook hype around a product that may not be worthwhile. They understand fundamental sector nuances, recognize unfound competitors, and have a stronger intuition on where a sector is going which enables them to do deeper diligence. Having operator-investors also gives a strong signal to traditional investors — Rahul Vohra investing in a productivity app, for example, shows more credibility than an investment from almost any other firm.

Invest: Differentiated Insights & Empathy that Wins Deals

In today’s fundraising environment, good founders have a lot of options and flexibility on who they raise capital from. Capital alone isn’t a differentiator and allocation on the cap table must deliver a high value per dollar invested.

Operator-investors are delivering more value because they have greater founder empathy and can directly speak about the opportunities and stress of assembling the right team, growing the business, and finding the right exit strategy.

A first-time founder building an Enterprise SaaS startup put it bluntly: “I’d rather raise from Jyoti Bansal (Founder of AppDynamics and VC at Unusual Ventures) than any partner who built their career only in venture capital. He understands that all businesses are held together with sticky tape and glue — that’s not something you can fully grasp or empathize with if you haven’t been in the trenches yourself.”

Support: More Tactical Portfolio Advice & Connections

While many firms have portfolio support teams, operator-investors can go far deeper and more specific in supporting portfolio companies since they are plugged into the vertical. Every operator-investor brings a unique flavor to portfolio support given their work in the operating space, essentially serving as an “extension” to the executive team across their work expertise (e.g. finance, product, business development).

Julia French, who works in finance at Octave, says she raised North Star Ventures because she sensed a disconnect between the language investors and founders speak. “A founder’s vision may fit with the investor’s vision but they may not speak the same business language. Being an operator who has spent time building similar businesses and financial models, I have deep empathy for founders and can be a bridge between founders and traditional VCs.”

Moreover, working alongside operator-investors unlocks a potentially valuable acquisition and business development strategy. Oftentimes, operator-investors work at companies that can partner with (or even possibly acquire) the startup they have invested in.

From helping recruit key hires through their network to ideating on strategic partnership opportunities with their operating role, operator-investors can add significant value in each stage of their portfolio company’s growth.

Conclusion

Our team at Pathway Ventures is confident that the time for operator-investors has arrived. We’ve already seen early-stage rounds ranging from $1M — $7M (really!) filled only with operators, and we believe that the number of operator-investors will skyrocket in the next year.

Overall, the deep integration of investing and operating is incredibly beneficial for tech: it’ll provide more “smart” money at the riskier stages, and enable good founders to ideate, experiment, and launch early products under the guidance of other players in the sector.

In the next few weeks, our team at Pathway Ventures will be highlighting several promising operator-investors — showcasing how their operating roles are enabling them to become better investors.

If you’d like to get in touch about this series, let Siya / Taylor know!

Special thanks to Sanya Ohri and Akash Bhat for help in assembling this piece!